The glass coach tour, throne speech, ceremonial dress code which includes hats and the suitcase! It is the third Tuesday of September and therefore ‘Prinsjesdag’. The budget (Million note) was presented by the finance minister and these are the key points.

” This Million Note is not about ourselves”, Minister Heinen began in the House of Representatives. “It’s about all ordinary Dutch people. People who have a job or business, people who do want to participate, but who are in a trend. People who deserve a good old age and young people to whom we want to pass on this beautiful country.”

The plans of the Schoof cabinet at a glance

Not all plans that have come out are new. Much had already been leaked or was already in the broad-line agreement or government program. These are some important themes:

- Migration: 95 million euros will be allocated for what the government calls the “strictest asylum regime ever”.

- Agriculture: It is an important theme for this government, but there are no major expenses for next year. From 2026, 1 billion euros will go to the agricultural sector for five years.

- Care: The healthcare premium will increase to 156 euros per year in 2025. The deductible will remain 385 euros next year, but from 2027 it is intended to be reduced to 165 euros. 162 million euros will also be available for AI in healthcare next year.

- Housing: The government will invest 5 billion euros annually in housing in the coming years, so that 100,000 homes should be added every year. 500 million will also be allocated to simplify the housing allowance.

- Infrastructure: Train tickets will be 6 percent more expensive instead of 12 percent. The Ministry of Infrastructure and Water Management assumes half of the price increase, NS the other half.

- Energy: Over the next two years, 60 million euros will be raised annually to help vulnerable households with their energy bills. The energy tax on gas is also going down.

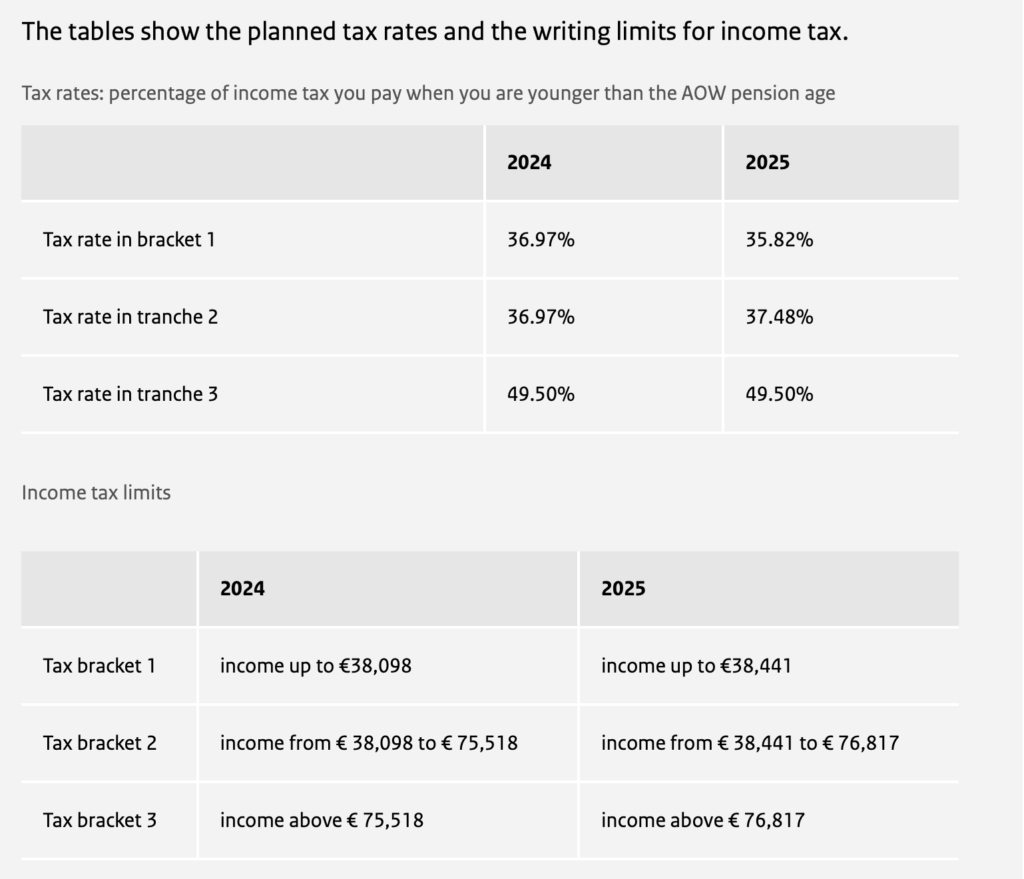

- Tax: An additional tranche in income tax yields both households with a small wallet and higher incomes.

- Education: The Ministry of Education, Culture and Science cuts 260 million on subsidies. The free school meals will not be canceled anyway.

- Justice: There will be an extra 120 million euros in the fight against crime gangs. The police will also receive a structural increase of 180 million euros.

- Defense: More money goes to the Ministry of Defense’s budget. That money goes, among other things, to the modernisation and renewal of equipment and to additional recruitment staff.

Partial reversal of 30% scheme austerity and increase in standard salary

The explanatory memorandum to the Tax Plan 2025 bill stipulates that the austerity of the 30% scheme from the Tax Plan 2024 (’30-20-10-scheme’) will be largely reversed and the maximum tax-free reimbursement will be set at a constant flat rate of 27% as of 1 January 2027. In the years 2025 and 2026, 30% exemption will apply to all incoming employees. Furthermore, the salary standard will be increased from €46,107 to €50,436 (2024 prices) and the salary standard for incoming employees under 30 with a master’s degree will be increased from €35,048 to €38,338 (2024 prices). For incoming employees who applied for the 30% scheme before 2024, respectful transitional law will apply which is 30% percent and the old (indexed) salary standards will continue to apply to them until the end of the term. In doing so, the government also wishes to comply with the Geerdink-

Moonen motion7, which calls on the government to come up with a proposal for the simplification of the 30% scheme that is less is harmful to the economy.

Cabinet proposal for income tax rates

Income tax from substantial holdings remains at 24.5 % until 67,804 Euros and after that becomes 31% as opposed to the current slab of 33%.

Changes in income tax for entrepreneurs

People who work as freelancers, or SMEs with a sole proprietorship or vof (partnership), will pay slightly more tax on average from 2025 if they make the same amount of profit. From 2025, entrepreneurs up to an income of €29,100 do not pay income tax (this is up to €30,700 in 2024).

Increase in rates for VAT or BTW

For culture, art, books and sports, the government wants to change the VAT rate from the reduced rate (9%) to the general rate (21%). New VAT rate for culture, art, books and sports applies from 1 January 2026. Thus, museum visits, cultural performances, books and sporting facilities are going to cost more. Overnight hotel stays are also included in this same tax bracket. However, the gambling tax will see changes in 2025. It will increase from 30.5% to 34.2% in 2025 and in 2026 to 37.8%

Road tax

The government proposes to give emission-free passenger cars a discount on the mrb (road tax) until 2029. The discount applies to new and used emission-free cars. From 2030, this discount will expire.

House Transfer tax

The government wants to reduce the transfer tax rate specifically for homes from 10.4% to 8%. That rate only applies if you buy a home that you are not going to live in yourself, such as a 2nd home or a holiday home to rent out.

For Eindhoven News: Beena Arunraj