As of January 1, 2023, the minimum wage will increase. The amounts of the statutory minimum wage apply to a whole working week. Usually, that is 36, 38 or 40 hours a week.

This depends on the sector in which you work and the possible collective agreements that apply to that sector. These collective agreements state how long a typical working week lasts. In supermarkets, for example, a whole working week is 40 hours. For instance, in the hotel and catering industry and greenhouse horticulture, it is 38 hours a week.

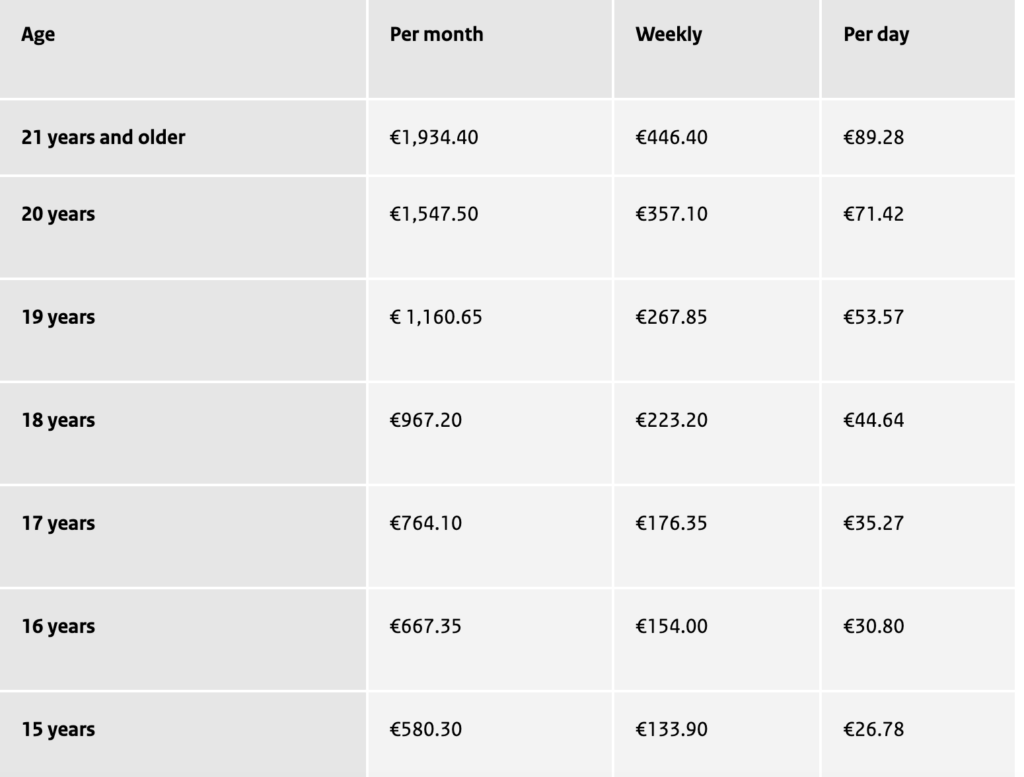

By month, week and day

Table: minimum wage per month, week and day (gross amounts per gross amounts as of 1 January 2023)

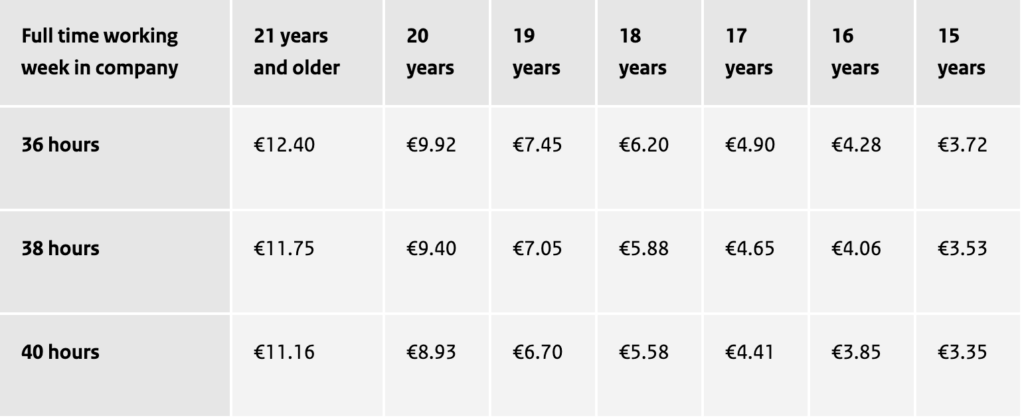

Table:

Minimum wage per hour for full-time working weeks of 36, 38 and 40 hours (gross amounts as of 1 January 2023)

(The amounts are rounded off to the nearest decimal.)

Basic income tax rate lower in 2023

The basic income tax rate drops from 37.07% to 36.93%. This rate applies to incomes up to €73,031. As a result of this reduction, working people will have a maximum of €102 more per year.

For Eindhoven News: Beena Arunraj