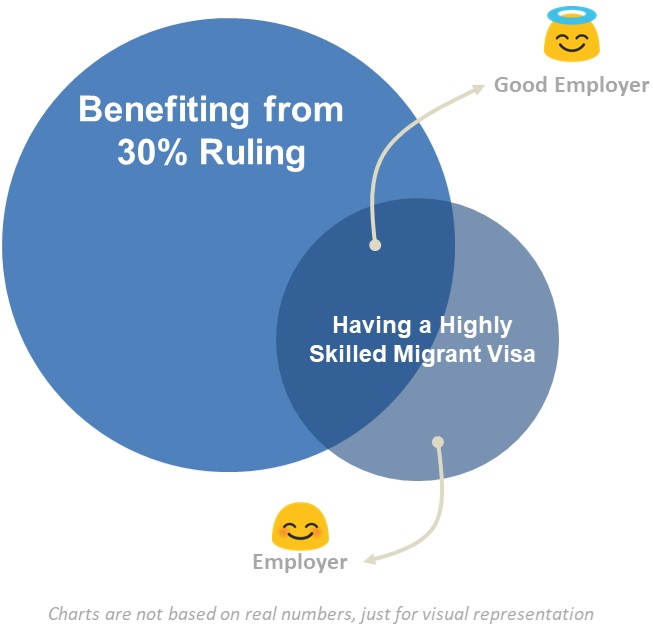

Oftentimes, the terms Highly Skilled Migrant Visa and 30% tax ruling are misunderstood or easily confused with the other. These are two different terminologies that should be explained independently.

First, let me introduce myself. My name is Erdem. If you are reading this article, the chances are high that you are an expat, like me.

An Eindhovener for more than 8 years and an ex-student at TU/e, now, I am working as an engineer. I am also an Ebru artist, an amateur photographer, interior design and design enthusiast. Also, every now and then, I try to put my thoughts and feelings into words.

So, I’m just your average run-of-the-mill highly skilled migrant living in the Netherlands.

Back to the main topic…

30% tax ruling is one of the hot topics for any expat who wants to work in the Netherlands. Because benefiting from 30% tax ruling means making more money. By the way, from now on, I will call it 30% ruling as we all commonly use that term.

being a highly skilled migrant is not a pre-requisition for benefiting from 30% ruling

There are some requirements that you have to satisfy to be eligible for that rule. But let me clarify one thing: being a Highly Skilled Migrant is not a pre-requisition to benefit from 30% ruling. For now, keep this in mind.

There are two main requirements:

- Distance Rule: You must be living at least 150 km away from the nearest Dutch border before you start working in the Netherlands. No cheating! You can’t just leave the Netherlands, have a holiday in another country for a month or so, and then turn back to the Netherlands to start your work and apply for 30% ruling. You should be living in a city satisfying than 150 km rule for at least two years back from the day you start the work. How is this distance calculated? Open Google Maps. Spot the city that you are living in right now, draw a straight line from your city to the closest Dutch border.

- Salary Rule: The Dutch authorities want to attract qualified people to the Netherlands. there are many vacancies, especially in the High Tech industry, and there are not enough qualified people currently living in the Netherlands to fill those positions. That is why they provide some benefits for qualified people to attract them easily. The primary benefit they provide is the 30% ruling. However, it is quite a hard job for the Dutch authorities to decide whether a person is qualified or not, and they also don’t like to be cheated. Therefore, they made a minimum salary rule. The logic behind is not entirely fair, but simple. They decide whether you are qualified or not via the salary that your employer is willing to pay. Hence, they determine a minimum salary limit every year. So your employer should declare to authorities something like that: “This guy has some qualifications/talents that I could not find within the current market of the Netherlands. And I am willing to pay that much money to bring her/him to the Netherlands’’

In light of the above information, let’s assume that you are living 150 km away. Then, check the minimum salary rule and be sure that the numbers in your contract are higher than this amount before you sign it. Of course, do this if you care about 30% ruling.

As of 1st of January 2019, below are the salary conditions:

- If you are over 30 years old: minimum required TAXABLE salary (70%) is €37.743 which is gross €53.919.

- If you are younger than 30 and obtained a master degree (from a foreign university): minimum required TAXABLE salary (70%) is €28.690 which is gross €40.986.

the law says that you must have a minimum taxable salary, but it does not mention a gross salary value

I intentionally wrote a couple of keywords and numbers in bold to clarify one of the most prominent false information related to 30% ruling. Let’s give a specific example. You are 32 years old. That means the salary condition in the first bullet point applies to you. You don’t have to have a gross salary of €53.919 to be able to benefit from the tax advantage. The law says that you must have a minimum taxable salary, but it does not mention a gross salary value.

In addition, it states that under the 30% ruling, you can benefit from a tax-free allowance of up to 30%. Consequently, 30% ruling does not mean that your benefit will and should always be 30% (repercussions of wrong naming!). In simple words, even if you have a salary of €38.000, you can benefit from “30%’’ ruling by lowering your percentage of benefit. The government only cares whether they can tax you over €37.743 or not. In that case, you can only profit over a non-taxed €257.

Ok, now we know that even if you have a salary of €38.000, you can benefit from ‘’30%’’ ruling, but of course, your benefit is not 30%. Let’s talk about the second part of the misunderstanding. This rule applies for both EU and non-EU nationalities who are coming outside of the Netherlands to work.

If you are from a non-EU country, by default you MUST / SHOULD and CAN satisfy the salary requirement of the 30% ruling. Because, IND says that if you are coming outside of EUROPE to work in the Netherlands, you are called as Highly Skilled Migrant, and you need a visa to work here. Obviously, this visa is called Highly Skilled Migrant Visa. You must earn a minimum of €4.500 gross (let’s stick on our previous example and keep the age as 32 years old) per month (excluding the holiday allowance). Otherwise, IND is not going to give you a visa and permission to work here in the Netherlands.

the salary of every highly skilled migrant who is above 30 years, by default, satisfies the minimum salary

So, if we make a simple calculation; we find that the yearly gross salary (including the holiday allowance) must be a minimum of €58.320 per year. That value is way above the minimum taxable salary: €37.743. Therefore, every highly skilled migrant who is above 30 years, by default, satisfy the minimum salary requirement.

I witnessed a couple of times that some non-EU expats were worrying that they could not benefit from 30% ruling because their salaries were not satisfying a minimum €4.500 monthly gross salary condition. Dear reader, if you are older than 30 years, and coming from a non-EU country, 30% tax benefit should not be the first thing that you are worrying about if you are getting a gross monthly salary less than €4.500! Your future in the Netherlands and your visa could be a cause of concern. Because your salary is not satisfying the minimum salary requirement for visa and IND can easily (maybe not that easy, but let’s keep the tension high) cancel your visa and kick you out of the country.

30% ruling is not a right, but a privilege

Dear non-EU expat reader, you should be aware that not all employees are aware of the minimum salary requirement rules, or some of them may abuse the rules knowingly. Therefore, you should protect your rights.

The last thing that I want to point out is a harsh reminder:

Don’t forget! 30% ruling is not a right. It is a privilege. Your employer does not necessarily have to agree with it! Yes, I wrote it correctly and you read it right. It is an agreement that you have to make with your employer. Because they have to write a letter to the government and apply for 30% ruling for you while explaining how invaluable you are for them and why they could not find a better employee in the Dutch market to do your job. Unfortunately, you have nothing to do about it if they don’t agree on that. Except for finding another job. I am giving this heads-up to decrease your frustration in case that your employer is not cooperative about the issue. Be sure that you agree on this term before you sign your contract.

To sum up:

- 30% ruling salary requirement and highly skilled migrant salary requirements are entirely two different things.

- As long as you have a gross salary of €37.743 and higher, you can benefit from 30% ruling.

- If you are a highly skilled migrant, you must satisfy a minimum salary condition to get a visa. And, if you managed to get a visa, that means your salary is already high enough to apply for 30% ruling.

- 30% ruling is not a RIGHT. It is a privilege. You cannot apply to it by yourself, your employer should apply for you, and they are not obligated to do that. So, you may not always get what you want.

With this article, I just wanted to clarify some misunderstood terminology. Of course, I could have made the text longer and wrote about more details that I had to skip to keep the text (relatively) short (I don’t want to bore you from my very first article). If you have any questions, feel free to ask. I can gladly write more about this topic.

If you want to contact with some professionals who can help you related to 30% ruling applications, my advice would be to contact Holland Expat Center. They can direct you to their partners who are experts in taxation in the Netherlands.

For Eindhoven News: Erdem Cerit

Hi, thanks for the detailed explanations! 🙂 As far as I understand, graduates who completes their studies in NL are not eligible for 30% ruling because of the distance condition. But you had also mentioned that you also graduated from a dutch university and apperantly benefitted from the ruling. Is that correct? Or is there any exemption in place? I’ll appreciate if you may answer. Thanks in advance!

I got my ruling approval just a few days ago at got paid out retrospectively for the duration of six months (the length of the procedure). I found a website that you can use for calculating your benefits – helped me. https://tax-calculator.net/dutch-tax-calculator/